When is it the Right Time to Get Life Insurance? [infographic]

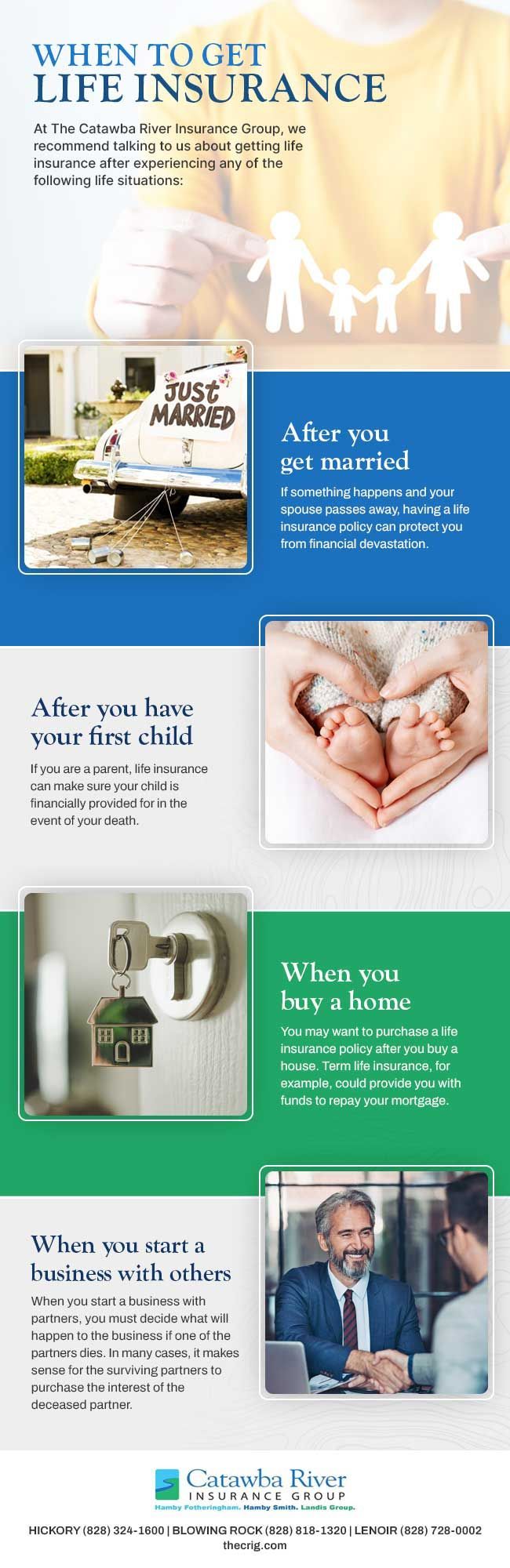

If you don’t currently have life insurance, you may wonder if you need this type of insurance. At The Catawba River Insurance Group, we recommend talking to us about getting life insurance after experiencing any of the following life situations:

• After you get married —Most couples make financial decisions based on multiple incomes after getting married. If something happens and your spouse passes away, having a life insurance policy can protect you from financial devastation.

• After you have your first child

—Raising a child and setting them up for the future is extremely expensive. If you are a parent, life insurance can make sure your child is financially provided for in the event of your death.

• When you buy a home

—You may want to purchase a life insurance

policy after you buy a house. Term life insurance, for example, could provide you with funds to repay your mortgage.

• When you start a business with others

—When you start a business with two or more partners, you must decide what will happen to the business if one of the partners dies. In many cases, it makes sense for the surviving partners to purchase the interest of the deceased partner. This way, the surviving partners can keep running the business and the family of the deceased can receive financial support.

We can help you decide between a term and whole life insurance policy, as well as help you find the right policy for your situation. Contact us today to make an appointment with our insurance agency.

The post When is it the Right Time to Get Life Insurance? [infographic] first appeared on The Catawba River Insurance Group.