Five Business Insurance Mistakes and How to Avoid Them [infographic]

The Catawba River Insurance Group • December 12, 2024

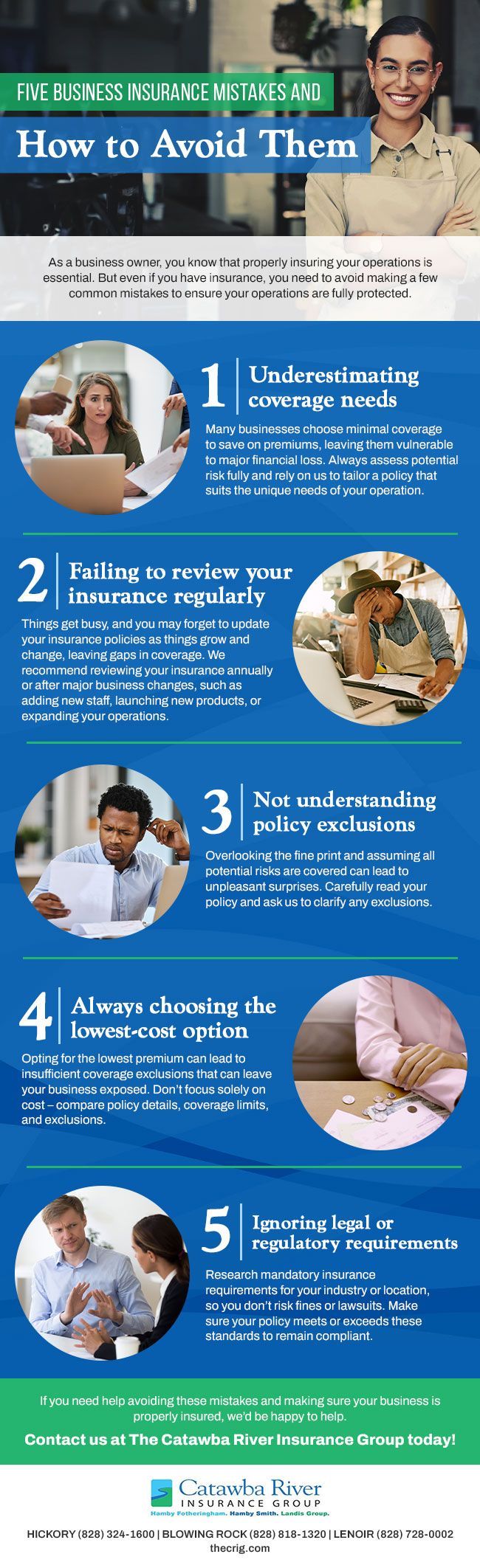

As a business owner, you know that properly insuring your operations is essential. But even if you have insurance, you need to avoid making a few common mistakes to ensure your operations are fully protected.

- Underestimating coverage needs – Many businesses choose minimal coverage to save on premiums, leaving them vulnerable to major financial loss. Always assess potential risk fully and rely on us to tailor a policy that suits the unique needs of your operation.

- Failing to review your insurance regularly – Things get busy, and you may forget to update your insurance policies as things grow and change, leaving gaps in coverage. We recommend reviewing your insurance annually or after major business changes, such as adding new staff, launching new products, or expanding your operations.

- Not understanding policy exclusions – Overlooking the fine print and assuming all potential risks are covered can lead to unpleasant surprises. Carefully read your policy and ask us to clarify any exclusions.

- Always choosing the lowest-cost option – Opting for the lowest premium can lead to insufficient coverage exclusions that can leave your business exposed. Don’t focus solely on cost – compare policy details, coverage limits, and exclusions.

- Ignoring legal or regulatory requirements – Research mandatory insurance requirements for your industry or location, so you don’t risk fines or lawsuits. Make sure your policy meets or exceeds these standards to remain compliant.

If you need help avoiding these mistakes and making sure your business is properly insured, we’d be happy to help. Contact us at The Catawba River Insurance Group today!

The post Five Business Insurance Mistakes and How to Avoid Them [infographic] first appeared on The Catawba River Insurance Group.

Driving a vehicle of any kind involves a certain level of risk, and different types of vehicles have different risks associated with them. Because the risks are different, the insurance for different types of vehicles is also different. Our team at The Catawba River Insurance Group has comprehensive knowledge of the various types of auto […]

The post Car vs. Truck Insurance first appeared on The Catawba River Insurance Group.

Our team at The Catawba River Insurance Group has extensive experience in the insurance industry, and you can count on us to help you find the best insurance for your needs. Over the years, we have answered countless questions about the various types of insurance and the differences between them, and we want to shed […]

The post Differences Between Personal and Commercial Auto Insurance first appeared on The Catawba River Insurance Group.

If you are renting a home or apartment, you may not think insurance is necessary since your landlord is required to have insurance. However, it’s important to note that your landlord’s insurance only covers the dwelling, not your belongings or specific unit. If you want liability coverage in case you damage the property or someone […]

The post Is Renters Insurance Worth It? first appeared on The Catawba River Insurance Group.