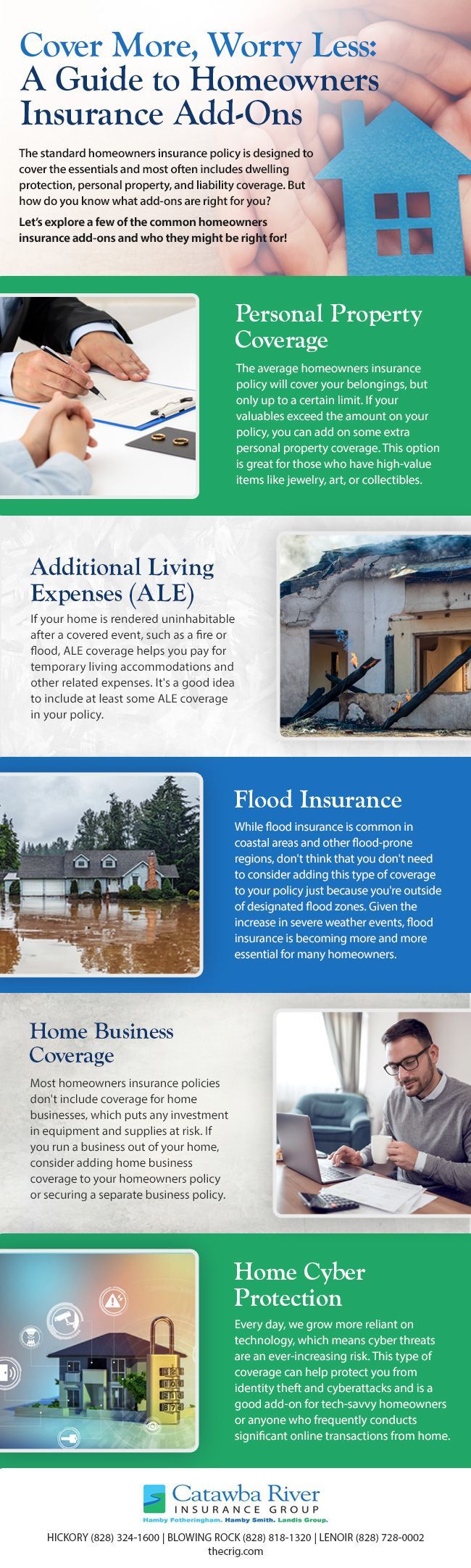

Cover More, Worry Less: A Guide to Homeowners Insurance Add-Ons [infographic]

The standard homeowners insurance policy is designed to cover the essentials and most often includes dwelling protection, personal property, and liability coverage. However, the landscape of risk can be difficult to predict, which is why many people find insurance add-ons to be an appealing option that can add extra coverage to a standard policy. But how do you know what add-ons are right for you?

Let’s explore a few of the common homeowners insurance add-ons and who they might be right for!

- Personal Property Coverage – The average homeowners insurance policy will cover your belongings, but only up to a certain limit. If your valuables exceed the amount on your policy, you can add on some extra personal property coverage. This option is great for those who have high-value items like jewelry, art, or collectibles.

- Additional Living Expenses (ALE) – If your home is rendered uninhabitable after a covered event, such as a fire or flood, ALE coverage helps you pay for temporary living accommodations and other related expenses. It’s a good idea to include at least some ALE coverage in your policy.

- Flood Insurance – While flood insurance is common in coastal areas and other flood-prone regions, don’t think that you don’t need to consider adding this type of coverage to your policy just because you’re outside of designated flood zones. Given the increase in severe weather events, flood insurance is becoming more and more essential for many homeowners.

- Home Business Coverage – Most homeowners insurance policies don’t include coverage for home businesses, which puts any investment in equipment and supplies at risk. If you run a business out of your home, consider adding home business coverage to your homeowners policy or securing a separate business policy.

- Home Cyber Protection – Every day, we grow more reliant on technology, which means cyber threats are an ever-increasing risk. This type of coverage can help protect you from identity theft and cyberattacks and is a good add-on for tech-savvy homeowners or anyone who frequently conducts significant online transactions from home.

Interested in learning more about what homeowners insurance add-ons are available? Our team is ready to assist you, so contact us today to start amping up your homeowners insurance policy with coverage tailored specifically to your needs and circumstances!

The post Cover More, Worry Less: A Guide to Homeowners Insurance Add-Ons [infographic] first appeared on The Catawba River Insurance Group.