Auto Insurance 101: Comprehensive vs. Collision Insurance [infographic]

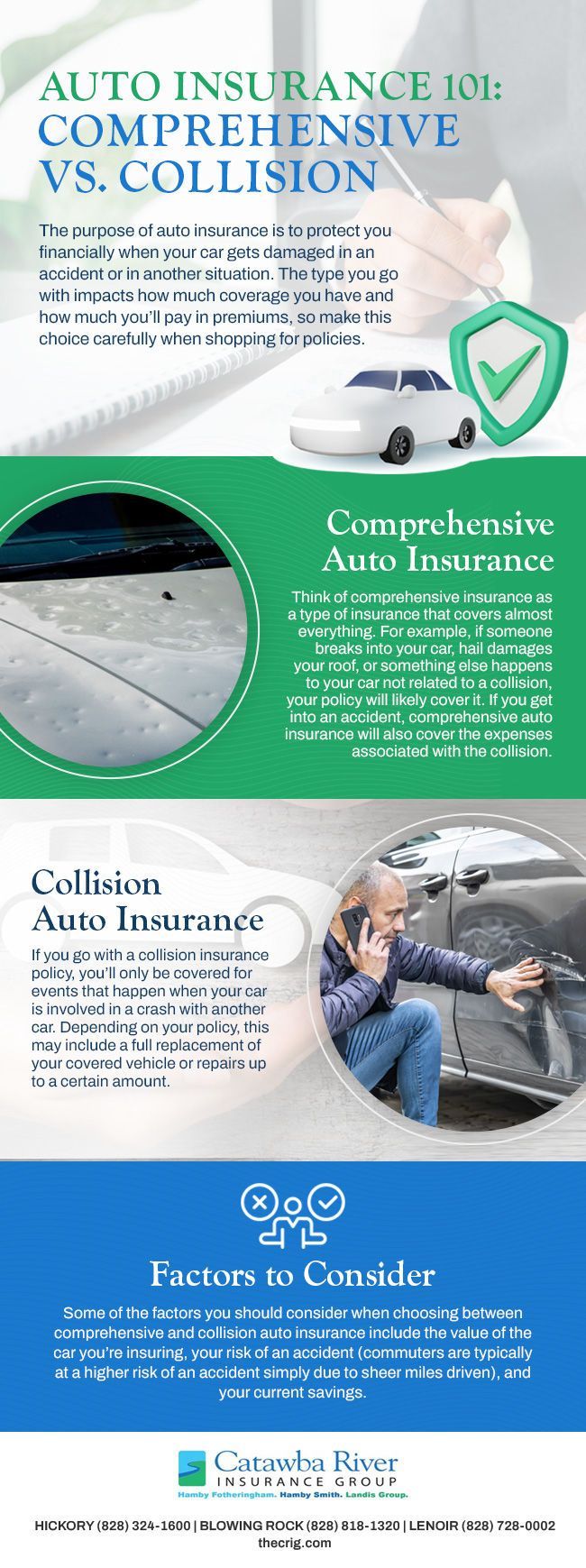

The purpose of auto insurance is to protect you financially when your car gets damaged in an accident or in another situation. When you’re shopping for a new policy, you’ll need to decide between comprehensive and collision insurance. The type you go with impacts how much coverage you have and how much you’ll pay in premiums, so make this choice carefully when shopping for policies.

• Comprehensive Auto Insurance . Think of comprehensive insurance as a type of insurance that covers almost everything. For example, if someone breaks into your car, hail damages your roof, or something else happens to your car not related to a collision, your policy will likely cover it. If you get into an accident, comprehensive auto insurance will also cover the expenses associated with the collision.

• Collision Auto Insurance . If you go with a collision insurance policy, you’ll only be covered for events that happen when your car is involved in a crash with another car. Depending on your policy, this may include a full replacement of your covered vehicle or repairs up to a certain amount.

Some of the factors you should consider when choosing between comprehensive and collision auto insurance include the value of the car you’re insuring, your risk of an accident (commuters are typically at a higher risk of an accident simply due to sheer miles driven), and your current savings. We’d be happy to talk to you more about the difference between these two types of auto insurance, as well as help you make a decision, so contact our insurance agency today.

The post Auto Insurance 101: Comprehensive vs. Collision Insurance [infographic] first appeared on The Catawba River Insurance Group.